Enabling financial outcomes that make lives better

We are a chartered accounting firm that likes what we do and that’s reflected in our work and the way we deal with our clients and each other.

Rock

Our core services are taxation accounting and compliance. Ensuring these are executed capably, efficiently and on a timely basis provides a solid foundation for adding value.

Paper

Planning and structuring provides a framework for success and security. Carefully considering the implications of future action from a commercial perspective represents sound practice.

Scissors

Using common sense, creative thinking and commercial experience, we assist clients by providing consulting services to address their distinctive and varied needs.

Latest News

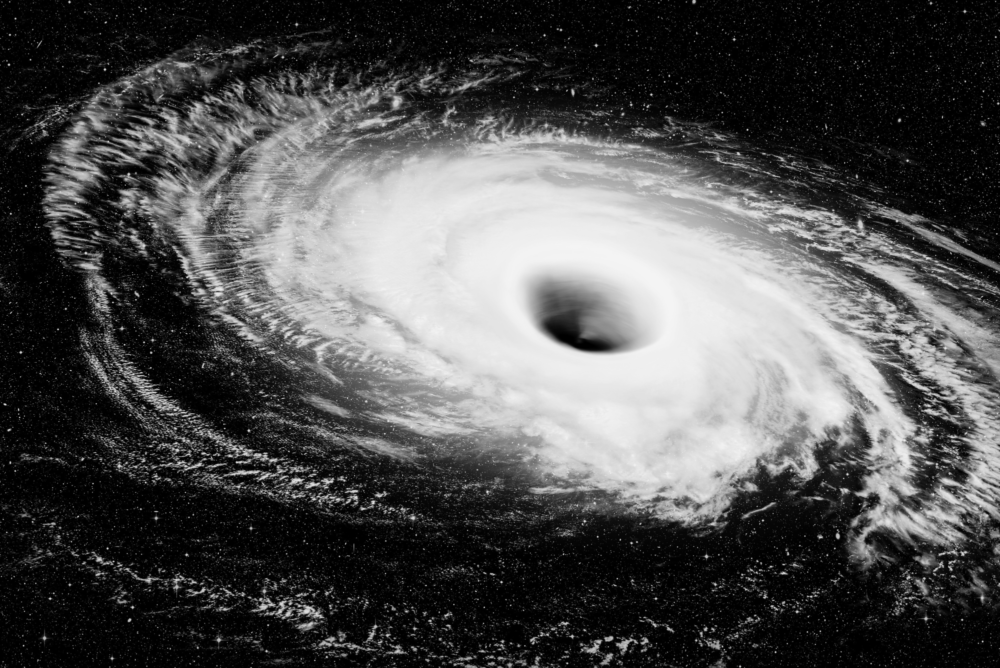

- The black hole of CGT and trustsTo say that the interaction of the Capital Gains Tax (CGT) laws and trusts is complicated is probablyone of the greatest understatements that anyone could make about the operation of the tax laws.The laws of physics may be much simpler – and, in this regard, it was Einstein who apparentlyquipped that “the hardest thing in… Read more: The black hole of CGT and trusts

- What tax receipts do I need to keep?Work-related expensesBut that isn’t quite right, as the tax rules in fact enable you to make legitimate claims for work-related expenses for up to $300 in a financial year without having receipts, provided:– you have spent the money;– the expense is directly related to earning your income;– you haven’t been reimbursed by your employer;– it… Read more: What tax receipts do I need to keep?

- Can you sell your SMSF assets to a related party?A common question SMSF trustees ask is whether they can sell or transfer their SMSF assets to a related party, like themselves or a family member. Selling to related parties is possible While there are rules about what assets an SMSF can buy from a related party, there’s no law that says you can’t sell… Read more: Can you sell your SMSF assets to a related party?